Description

Philly Finances: The Small Tax Breakdown

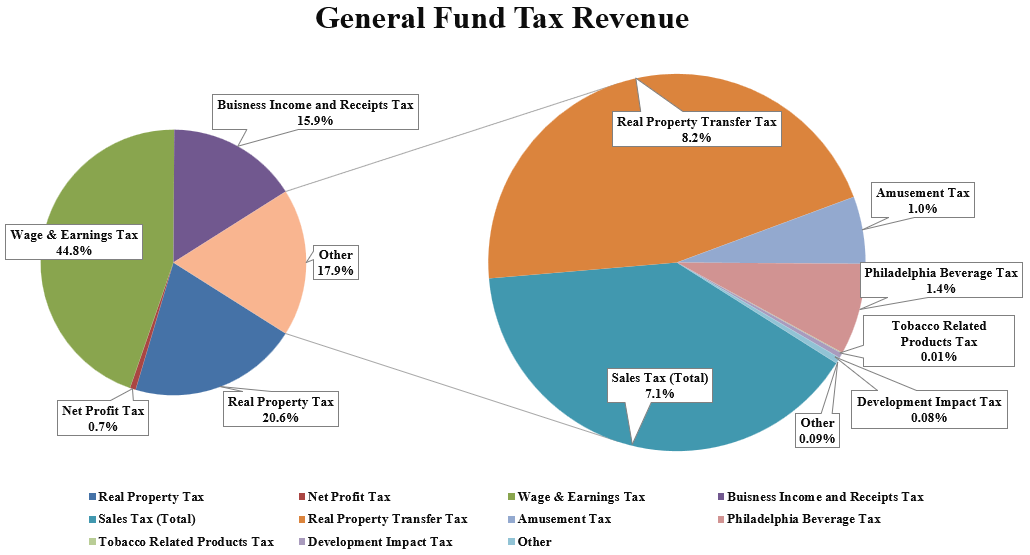

Philadelphia’s estimated General Fund revenues per the FY26 Adopted Operating Budget total $6.36 billion, which is supported by local tax and non-tax revenues, revenues from other funds, as well as funds the city receives from the state and federal governments. Of the total, $4.56 billion comes from city taxes, with $3.74 billion—about 82%—derived from major sources like the Wage Tax, Property Tax, and key business taxes, including the Net Profit Tax (NPT) and the Business Income and Receipts Tax (BIRT). Alongside these major revenue sources, Philadelphia also collects a variety of smaller taxes (18%) that play an important supporting role in the City’s finances.

Realty Transfer Tax – $373M

• Philadelphia’s largest “small tax,” applied when real property is bought, sold, or transferred, driven primarily by home sales and commercial real estate transactions.

• Supports General Fund operations and it is proposed to help fund the Housing Opportunity Made Easy (H.O.M.E.) initiative.

Sales Tax – $324M

• Philadelphia levies a 2% local sales tax on goods and services, in addition to Pennsylvania’s 6% state sales tax.

• The 2% local portion is split evenly between the School District of Philadelphia and the City’s Pension Fund, as required under state law.

Philadelphia Beverage Tax – $64M

• A tax on soda and other sweetened drinks sold in the city.

• Supports PHLpreK, Community Schools, and the debt service for Rebuild (parks/library) projects.

Amusement Tax – $47M

• Imposed on admission fees for attending amusements in Philadelphia such as concerts, sporting events, movies, and shows.

• Supports General Fund services.

Development Impact Tax – $3.5M

• A tax collected for the construction or improvement of residential properties valued over $15,000.

• Provides resources for the Housing Trust Fund, workforce development and diversity programs, and other housing assistance programs.

Tobacco and Tobacco Related Products Tax – $514,000

• A small excise tax on tobacco and tobacco-related products, such as cigars, rolling papers, and loose tobacco.

• City rates include $0.036 per individually rolled item, $0.36 per pack of rolling papers, and $0.36 per ounce of other tobacco products.

• Revenues support General Fund operations.

Each month Controller Brady looks forward to bringing transparency and accountability of our city, right to you.