Almost $60 million at risk over next five years if Homestead Exemption Program is not addressed

FOR IMMEDIATE RELEASE: Dec. 4, 2024

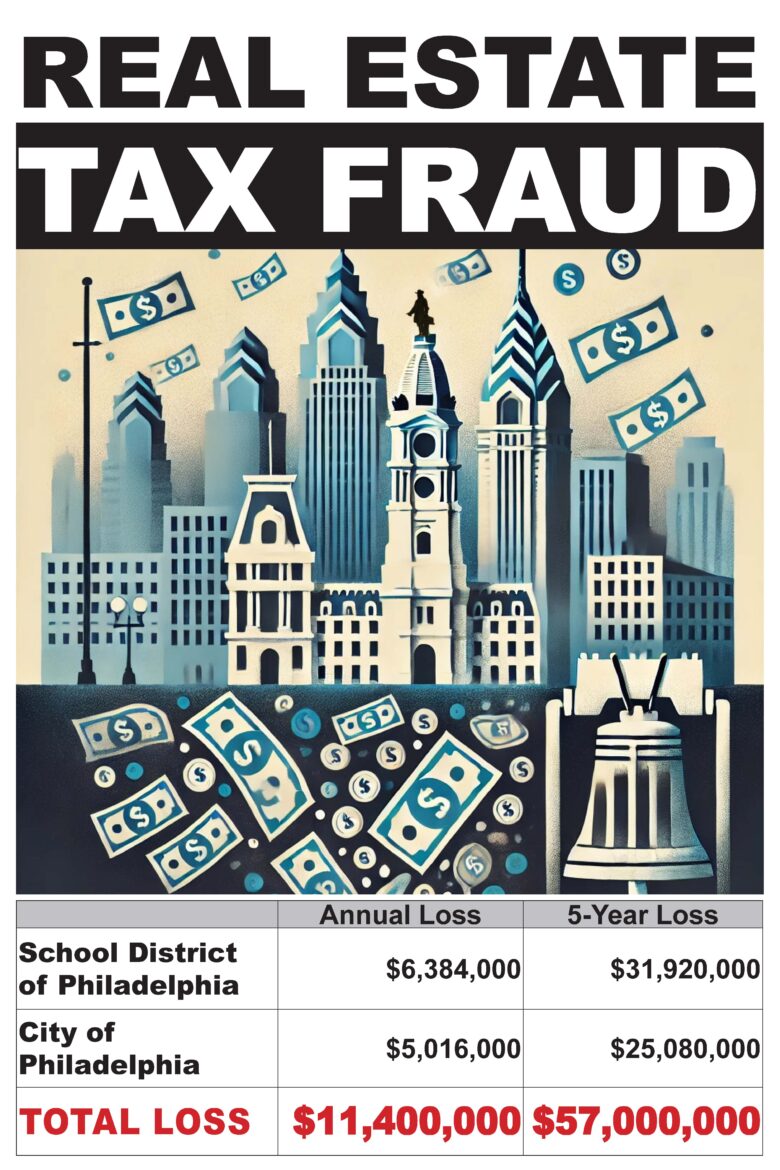

PHILADELPHIA – City Controller Christy Brady today released a special investigation of the Philadelphia’s Homestead Exemption Program that found the city and the School District of Philadelphia are losing a combined $11.4 million annually by individuals who are taking advantage of the program.

The exemption reduces the taxable portion of a property’s assessed value. For 2025 Real Estate Taxes, most homeowners will have their property’s assessed value reduced by $100,000, saving them almost $1,400 a year. However, the City Controller’s investigators identified 23,000 properties that appear to be ineligible to receive the exemption.

“The exemption is available only for individuals who own and live at their property, which is their primary residence,” said Controller Brady. “The Homestead Exemption Program provides property tax relief for many Philadelphians, yet many individuals are taking advantage of it.”

Controller Brady continued, “We believe these individuals are committing Real Estate Tax Fraud.”

The investigation was conducted through a data mining process and cross-checking of property records. The findings of ineligible properties were placed into four main categories:

- Businesses that own one or more properties

- Multiple properties with the same mailing address

- Owners with mailing addresses outside the city, some even in California, and

- Owners having the exemption applied to multiple properties.

“The city and School District of Philadelphia are missing out on millions of critical dollars every year. They stand to lose out on $57 million over the next five years if this issue is not properly addressed.”

A mapping of the properties with illegitimate homestead exemptions by zip code revealed the heaviest concentrations located in sections of the Lower Northeast and South Philadelphia neighborhoods.

The Controller’s findings were provided to the Office of Property Assessment and the Department of Revenue, along with several recommendations:

- Strengthen the verification process for property ownership and ensure each property owner claims one homestead exemption.

- Cross-check mailing addresses by using city databases to flag properties with identical or similar owner names and mailing addresses.

- Conduct reviews for properties with homestead exemptions where owners reside outside Philadelphia to confirm eligibility.

- Establish enforcement penalties for improper exemptions and recouping lost tax revenue.

“We recognize this issue has been a priority for many City Council members, including Council President Kenyatta Johnson, who raised it during last year’s budget process,” said Controller Brady. “We look forward to working with City Council and the Mayor’s Administration to translate our recommendations into actions.”

The City Controller also recognized a long-time Philadelphian who came to the office with his concern about homeowners filing multiple exemptions. He has conducted his own research over the years and provided the Controller’s Office with a starting point to expand the work across multiple databases and across the city.

“Concerned, caring citizens make our institutions and our city stronger together,” said Controller Brady. “The door to my office will always be open so as a city we can provide the most efficient, effective government for our residents.”

Visit https://controller.phila.gov/ to view the City Controller’s latest report.

###