The fiscal year (FY) 2023 budget offers an opportunity to focus the City’s priorities on building an equitable and sustainable recovery from the COVID-19 pandemic. With more than $1 billion in federal funds left to allocate, resident participation in the City’s budget process has never been more important. This analysis is the first part of an ongoing series that will examine key elements of the City’s budget process, presenting historical context and data in short, easy-to-understand sections. The Controller’s Office believes that understanding how the budget works is a crucial first step toward residents having a voice in determining these priorities.

The Public Budget Process

The City’s budget is the mayoral administration’s plan for spending, adjusted as needed to obtain City Council approval and passage before the start of each fiscal year beginning on July 1. It is a clear illustration of the mayor’s priorities, committing funding to projects, programs and departments that fit within the mayor’s vision. The City’s public budget process includes the following steps:

- The mayor’s proposed budget is announced and delivered to City Council, typically in March each year.

- Once the proposed budget is announced, City Council holds public hearings in April and May with administration leadership to understand the mayor’s spending proposal. These hearings include testimony from department heads and independently elected offices to support their proposed budgets and answer questions from councilmembers

- During this period, City Council also holds public comment sessions for residents to provide feedback on the proposed budget.

- Before the budget is approved, City Council may adjust funding levels for departments and programs.

- City Council passes legislation approving the budget before the end of the fiscal year on June 30, and the mayor signs the adopted budget legislation.

The General Fund Budget in the Last 15 Years

The City’s General Fund is its main operating fund. It supports core, resident-facing municipal functions like police officers, firefighters, trash collection, parks, and libraries. It also funds back-office administrative functions such as public property management, revenue collection, and the maintenance of the City’s fleet of vehicles.

Most importantly, the General Fund is primarily funded through taxes. Historically, about 75% of General Fund spending is funded through taxpayer dollars. Philadelphians deserve to understand how their taxes are being spent. To that end, this analysis discusses the major trends in the City’s General Fund budget over the last 15 years. It provides necessary historical context for understanding how the City’s current budget of about $5.4 billion came to be.

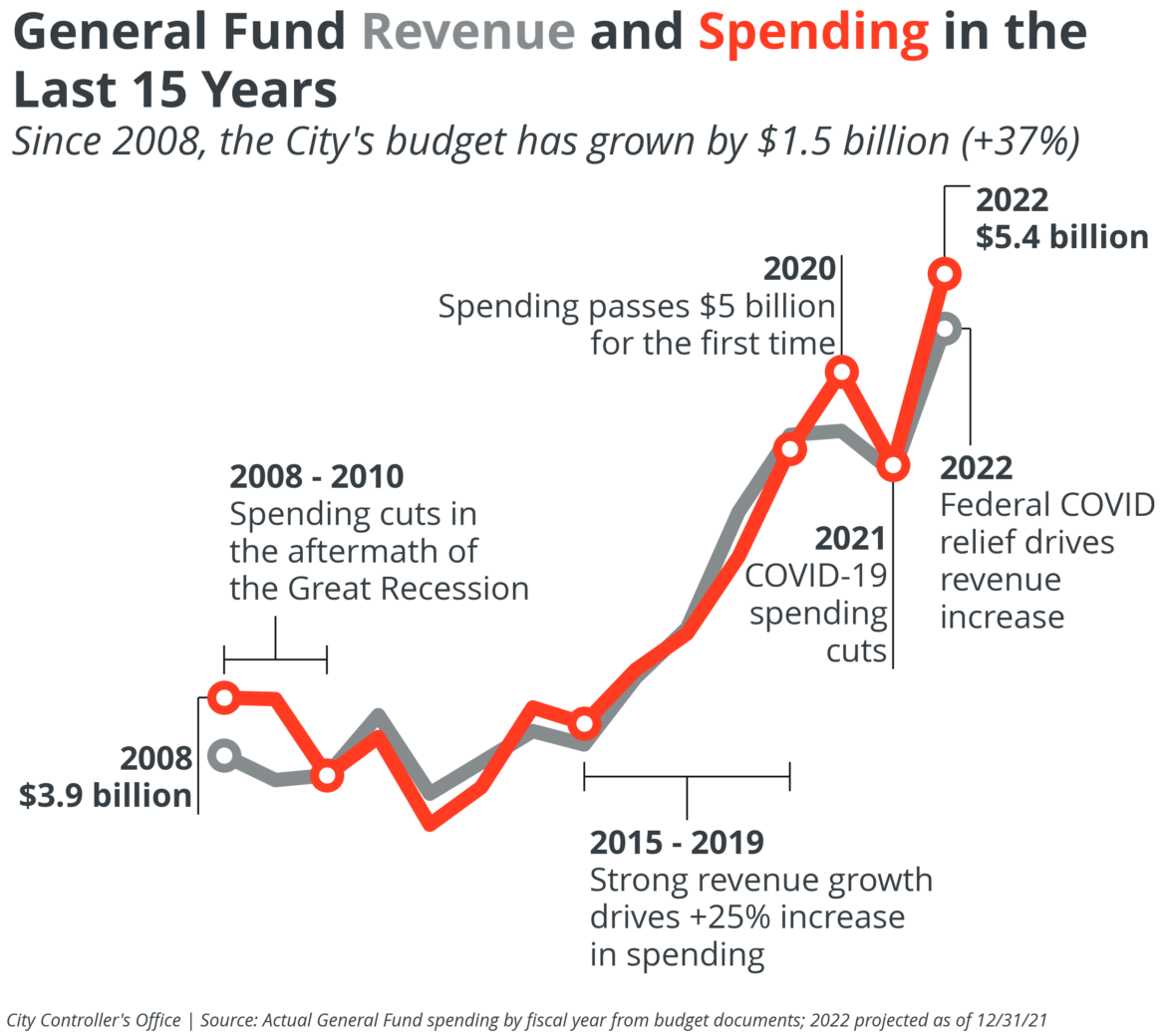

The chart below summarizes the major trends driving the City’s budget over the last 15 years. Before diving into these trends, there are a few important pieces of context to know:

- As required by law, the City must balance its budget each year.

- During periods of economic growth and low unemployment, the City typically collects more revenue. The City’s largest tax revenue source, the wage tax, is directly dependent on the unemployment rate and the number of people employed in the city. During the years of strong economic growth prior to the pandemic (FY 2015 to FY 2019), the City’s spending levels increased as revenue increased.

- Revenues decline during economic downturns or recessions, forcing the City to identify spending inefficiencies, use surpluses from prior years, make budget cuts, or raise taxes to ensure the budget is balanced each fiscal year.

The following chart shows how these trends have played out since the Great Recession in 2008.

Since FY 2008, General Fund spending has grown by about $1.5 billion, or +37%. For comparison, inflation — the increase in consumer prices over time — was only 24% over that same time.

Much of the growth in spending occurred between FY 2015 and FY 2019 during a period of strong revenue growth. General Fund spending increased by 25% during these years.

The period of revenue growth ended in 2020 with the onset of the COVID-19 pandemic. Spending cuts were made, and spending fell by about 6% from FY 2020 to FY 2021, the largest single-year decline since the years following the Great Recession.

The City’s spending has rebounded faster from the COVID-19 pandemic than it did from the Great Recession. The City is projected to spend $5.4 billion in FY 2022, the most in its history, and an increase of 14% from FY 2021.

The increase in spending in FY 2022 would not have been possible without federal relief from the American Rescue Plan (ARP). The city’s economy continues to be impacted by the pandemic, and tax revenue totals remain well below pre-pandemic forecasts. To replace this lost revenue, the City received an unprecedented $1.4 billion in ARP funds. The City is slated to use $250 million of that total during FY 2022, boosting the City’s total revenue by about 5% overall. This accounts for about half of the City’s total revenue growth in FY 2022.

Stay tuned: Part 2 dives into what the City spends money on and how much of the budget can be changed each year.