For immediate release: Friday, April 20, 2018

Contact: Jolene Nieves Byzon, 215-300-1071

Philadelphia, PA – The City Controller’s Office released a policy analysis of the Ten-Year Tax Abatement, including data around the concentration and distribution of abated properties by geography and value, the profitability of development in Philadelphia, and scenarios presenting and evaluating six hypothetical changes to the policy.

“The Ten-Year Tax Abatement, a much-needed tax incentive at its inception, has spurred development in the city – development that may not have happened otherwise. On the other hand, long-time residents and homeowners feel frustrated by what they believe to be an unfair benefit going to wealthy developers, investors and individuals. With yet another property tax rate increase on the table, this frustration is only growing,” said City Controller Rebecca Rhynhart. “My goal in looking at the ten-year tax abatement was to provide the Mayor and City Council with the information needed to make a data-driven decision as to keeping, ending or changing the policy. Incentivizing growth is important for the entire city, but it must be done in a fair and inclusive way. This analysis is a starting point for how to move forward as a city with that in mind.”

The policy analysis looked at historical data, finding that Philadelphia’s total number of properties has grown by approximately 15,000 over the life of the abatement and that our regional share of development has increased, as well as significant appreciation in the City’s median home value per square foot since 1996.

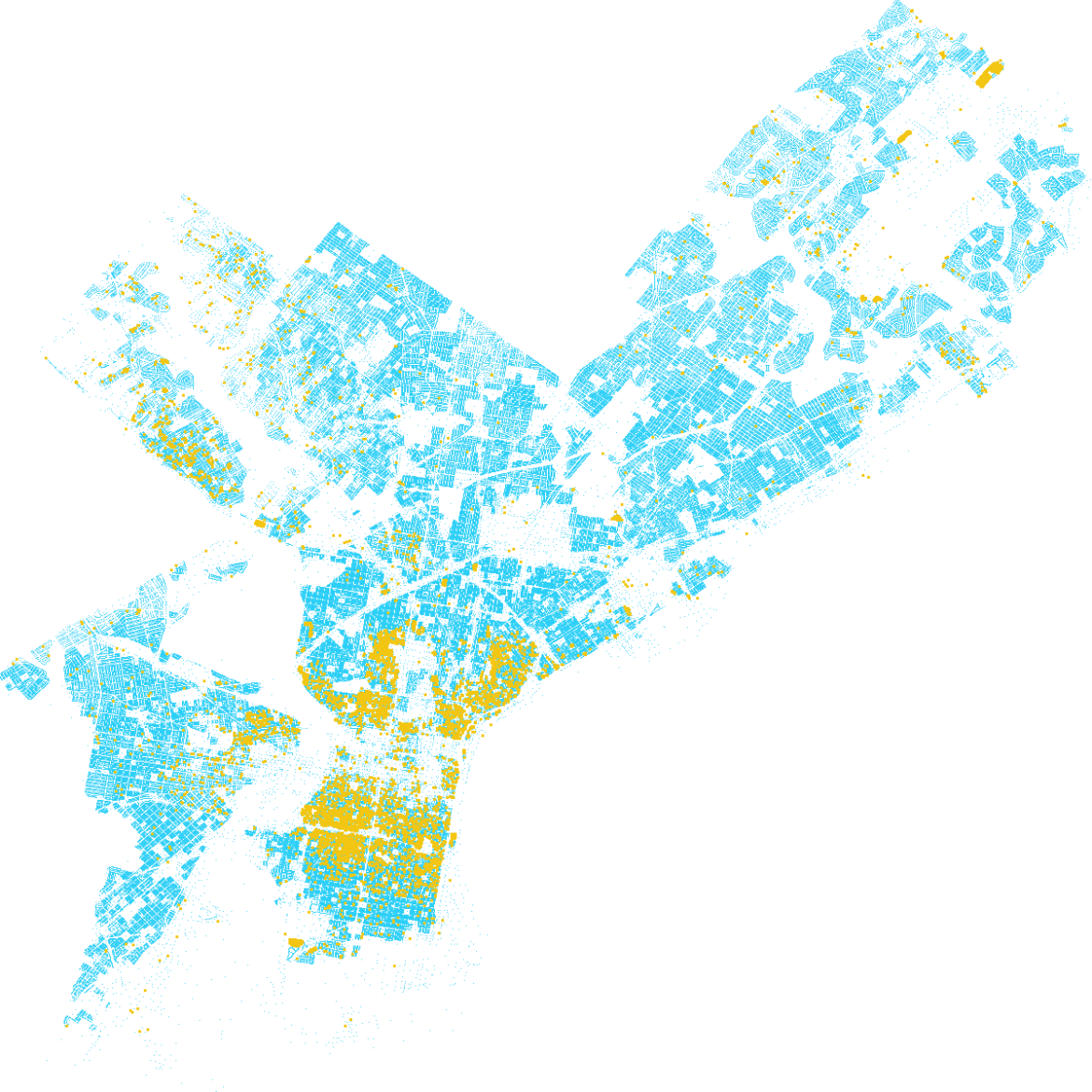

The analysis also examined active abatements by value and geography. Highlights include:

Abated properties valued above $700,000 make up just 7% of actively abated properties, but receive more than half, 51%, of the tax benefit from all abatements;

The median home value per square foot for abated residential properties is $202 – 93% higher than the citywide median home value per square foot of $105; and

Abatement tax benefits are concentrated in Center City and its surrounding neighborhoods. In total, 59% of the tax benefit for active abatements go to just 6% of Philadelphia neighborhoods.

The report also focuses on Philadelphia’s development profitability, including market values, rent prices and construction costs. Findings show that most ZIP codes are not profitable for development, even with an abatement. However, it also shows that the top ZIP codes for development are likely profitable regardless of the abatement.

Additionally, the report evaluates six hypothetical policy changes: rescinding the abatement completely; rescinding only the portion that funds the Philadelphia School District; capping the abatement at $700,000 or at $150 per square foot; removing it in the most profitable ZIP codes and amortizing the abatement over its lifetime. For more information on the policy changes examined.